The wet weather may be dampening sales for Scotts Miracle-Gro’s core lawn-and-garden business, but the company has its sights on the grow lights at the end of the tunnel.

CEO Jim Hagedorn on Tuesday underscored his firm’s “big vision” for hydroponics and the seriousness with which Scotts is approaching that sector as more states adopt medical and recreational marijuana laws.

“We have no sense of humor about that” potential maturation of the hydroponics business, Hagedorn told analysts during the company’s fiscal second-quarter earnings call. “This is a space we understand really well. We’re growing-people.”

And if other deep-pocketed companies or private equity want to step in, Scotts is ready to step up, he said.

“We intend to succeed in that space,” Hagedorn said. “I would say to anyone who wants to rumble with us, come on, let’s do this.”

The Marysville, Ohio-based Scotts has emerged as one of the biggest players in traditional business to publicly establish a foothold in the ancillary wings of the cannabis industry. The company has acquired several sector-leading firms across hydroponics areas such as lighting, soil and nutrients, and wrapped those into its Hawthorne Gardening Co. subsidiary.

Scotts has a few more acquisitions waiting in the pipeline, but some are taking longer than expected, Hagedorn said, attributing any delays to the logistics of these firms being smaller, family-owned businesses.

“We expect to complete most of these deals by the end of the year,” he said.

The buyouts inked to-date have resulted in revenue growth that has “significantly exceeded expectations.”

Hawthorne’s total sales were not disclosed in Scotts’ earnings report and initial related public filings made Tuesday. However, the subsidiary’s growth spurt was evident in the company’s top line for the second quarter and six month fiscal-year-to-date, which ended on April 1, 2017:

U.S. consumer sales dropped 7 percent to $962.5 million for the quarter, and fell 6 percent to $1.09 billion over the past six months; consumer sales in Europe fell 8 percent in both the quarter and fiscal six months to $105.3 million and $129.7 million, respectively. The “Other” category — consisting of lawn-and-garden business outside the U.S. and Europe, a supply agreement with Israel chemicals, and the hydroponics and urban gardening businesses — saw a 50 percent sales spike in the quarter to $135.7 million and a 59 percent jump for the fiscal year-to-date to $232.6 million.

Most of those growth spikes came from acquisitions, Hagedorn said, noting that Hawthorne also is experiencing strong, organic growth.

Each of the hydroponics businesses within Hawthorne — including General Hydroponics, Gavita and AeroGrow — had double-digit sales growth in the quarter, bringing the hydroponics portfolio’s quarterly sales growth to 22 percent and fiscal year-to-date sales growth to 13 percent, Hagedorn said.

“The overall landscape continues to look positive for Hawthorne,” he said.

Separately, Scotts on Tuesday announced plans to sell its European and Australian business operations, a deal that would result in 95 percent of the firm’s sales and profits being derived from the United States.

The transaction, which could result in $150 million in cash proceeds to Scotts, signals another significant aspect of the transition for the “quintessential American company” as it looks to counter a slowdown in its core business, Hagedorn said.

“We love our core business, but I think we view it as somewhat mature and slow-growing,” he said.

The ventures into areas such as hydroponics allow Scotts to start “buying growth” in categories with greater potential.

As that hydroponics market evolves from the recreational grower to the professional grower, Scotts has that lineage and technical sophistication that could serve the needs of both smaller and larger growers alike, Hagedorn said.

“I’m very comfortable where we’re going with this,” he said.

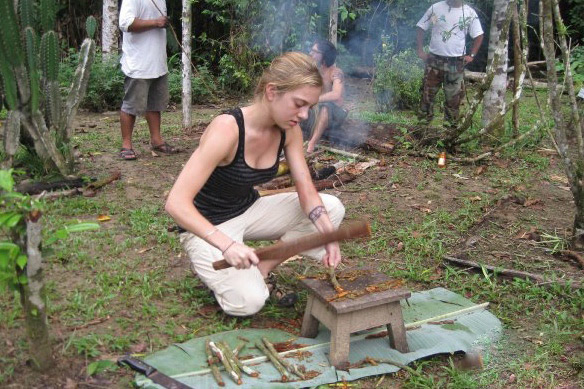

Rachael Carlevale studied plant medicine in Peru with the Shipibo, an indigenous tribe. (Courtesy of Rachael Carlevale)

Rachael Carlevale studied plant medicine in Peru with the Shipibo, an indigenous tribe. (Courtesy of Rachael Carlevale)